Construction Loans 101: How Progress Payments Work in QLD

Decode construction lending so your build stays on track.

If you’re building in Brisbane, the Gold Coast, or anywhere across Queensland, understanding how construction loans and progress payments work can be the difference between a smooth, on-time build and a stressful, stop–start experience. This deep-dive is written for first home buyers at the consideration stage, demystifying each step from finance pre-approval to the final draw. You’ll learn how timelines actually play out, how lenders release funds, where delays commonly happen—and what you can do right now to keep momentum and protect your budget.

Throughout, we’ll also touch on practical design choices for QLD’s climate—like choosing a white colour bond roof for better thermal performance—and essential compliance considerations, including ensuring any pool has a glass fence or a government-certified fence installed and certified before handover.

Keywords naturally addressed: construction loan QLD, progress payments Brisbane, building finance Gold Coast.

What is a construction loan—and why it’s different

A construction loan is a home loan released in stages as your home is built. Instead of getting the entire amount at once, your lender pays your builder at specific milestones (called “progress payments”). You typically make interest-only repayments during construction on the amount drawn so far; after the home is complete, your loan usually converts to standard principal-and-interest.

Why first home buyers in QLD should care:

- You only pay interest on what’s been drawn, which helps cashflow.

- Lenders rely on a fixed-price building contract and a progress schedule that matches Queensland norms.

- Each stage is verified before the lender releases funds—this can involve your authorisation, the builder’s invoice, and sometimes a valuation or inspection.

In simple terms: the bank pays for completed chunks of work, not promises—and you’re part of the sign-off loop.

The end-to-end journey: From pre-approval to final draw

1) Pre-approval: your confidence check

Pre-approval is your lender’s early thumbs-up on borrowing capacity. It’s not a blank cheque, but it gives you a working budget for land and build.

Expect to provide:

- ID, payslips, bank statements, and details of any debts

- Estimate of project costs (land + construction + site costs + contingency)

- Notes on the type of build (custom home, modular prefabricated, knockdown–rebuild), location (e.g., Brisbane or Gold Coast), and design approach

If you’re designing for QLD’s climate—like opting for a white colour bond roof to reflect heat—flag it. Energy-smart designs can reduce running costs, which some lenders view positively.

First home buyer essentials:

- Ask your lender or broker about QLD first home buyer concessions and any current grants. Eligibility and rules change, so confirm the latest.

2) Choose your builder and lock in a fixed-price contract

Queensland lenders prefer (and in practice, expect) a fixed-price contract with a clear progress payment schedule that aligns with state rules and industry standards.

With The Markon Group (custom home builder) and Homes by Markon (build-ready pathway for clients), you can expect:

- A detailed scope of works and inclusions list

- A compliant progress schedule matched to QLD requirements

- Evidence of insurances (e.g., QBCC Home Warranty Insurance) and builder licences

- Clear specifications that include climate-smart features like a white colour bond roof as standard advice

Considering modular prefabricated?

- The Markon Group also designs and imports custom-built modular prefabricated buildings. Lenders do fund modular projects. Your contract should clearly outline factory milestones, delivery logistics, and on-site installation stages so lender inspections and draws align with real progress.

Pro tip:

- Get thorough site information early (soil tests, engineering, flood/bushfire overlays). This keeps budgets realistic and reduces valuation surprises.

3) Unconditional approval: the green light to start

After your plans, specs, and fixed-price contract are final, the lender moves from pre-approval to unconditional (formal) approval.

They’ll typically review:

- Signed build contract and progress payment schedule

- Plans, specifications, and any variations

- Builder licence and insurances (QBCC)

- On-completion valuation

About valuations:

- The lender values the finished home based on land + construction. If the valuation lands lower than you hoped, The Markon Group can help adjust non-structural specs or inclusions to preserve quality while keeping the valuation within a comfortable range.

4) Land settlement (if applicable)

If you’re purchasing land, that portion usually settles first. You’ll pay interest on the land loan while you wait for construction to begin. If you already own land, its equity may form part or all of your deposit.

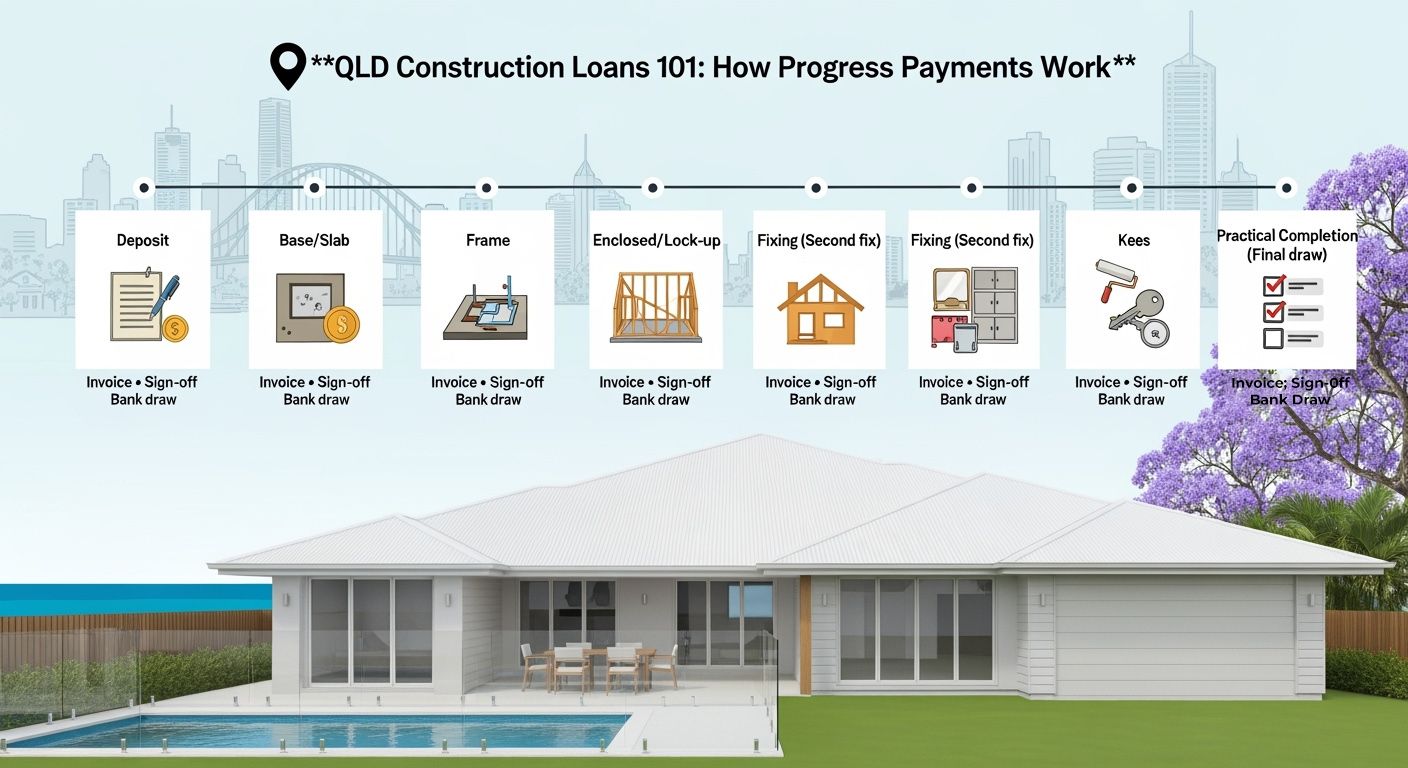

5) Construction starts: progress payments begin

Construction funds are released in stages. While exact names and percentages vary by contract, a typical QLD flow includes:

- Deposit

- Base/Slab

- Frame

- Enclosed/Lock-up

- Fixing (second fix)

- Practical Completion (Final draw)

How each draw is released:

- Builder issues an invoice for the stage

- You authorise the claim

- The lender may request an inspection/valuation

- The lender releases funds to the builder

Your role:

- Keep a simple checklist of what each stage covers (see below) so you can approve claims confidently.

- If you’re adding a pool, coordinate timing so a glass fence or a government-certified fence is in place and certified prior to handover.

6) Inspections, variations, and keeping momentum

Lenders may send a valuer to confirm stage completion. Variations (changes to the contract) can trigger extra checks.

To avoid delays:

- Minimise mid-build variations—batch decisions early (kitchen, bathrooms, flooring, façade, white colour bond roofing).

- If you must vary, ensure the price and timeline impact are clear and documented. Tell your lender promptly if it changes the contract sum.

7) Practical completion and final draw

At practical completion, you’ll do a detailed walkthrough and generate a defect list (if any) with your builder. The builder provides:

- Compliance certificates (plumbing, electrical, energy efficiency as applicable)

- Warranties and manuals

- Pool compliance documentation if a pool is included (glass fence or government-certified fence must be installed and certified prior to handover)

- Final invoice for the lender’s last draw

Once the lender releases the final payment, you receive keys and your loan converts to principal-and-interest (unless otherwise arranged).

Progress payment stages: what’s included and what to check

Note: Exact stage names and percentages vary by contract type. Always defer to the progress schedule in your signed contract and to QBCC guidelines where applicable.

1, Deposit

- Purpose: Secures your build slot and covers early work (engineering, surveys, admin).

- Your checks: Confirm deposit limits and documentation align with your contract. Keep proof of payment.

2, Base/Slab stage

- Work: Site cut, excavation, footings, slab, initial plumbing groundwork.

- Your checks: Slab thickness per engineering, termite management system, site drainage setup.

3, Frame stage

- Work: Structural frame and roof trusses installed.

- Your checks: Frame layout matches plans; verify prep for a white colour bond roof installation for heat reflection and longevity in QLD conditions.

4, Enclosed/Lock-up stage

- Work: External walls, windows, external doors, roof and cladding—home is weather-tight.

- Your checks: Windows/doors installed per spec; roof installed (white colour bond roof), and cladding sealed against weather.

5, Fixing stage (Second fix)

- Work: Internal linings, cabinetry, skirting, doors, tiling prep, electrical and plumbing fit-off in progress.

- Your checks: Cabinetry layout and finishes; bathroom waterproofing; lighting and power locations as selected.

6, Practical completion (Final draw)

- Work: Painting, flooring, final electrical/plumbing, appliances, external works. Pools (if included) must have compliant glass fencing or a government-certified fence installed and certified.

- Your checks: Thorough walkthrough with a defect list; confirm certificates and warranties; ensure pool compliance documentation is provided before handover.

Remember: Lenders may request an inspection at any stage. Build a small time buffer to allow booking, inspection, and reporting.

Your cashflow during the build

- Interest-only repayments: You pay interest on the amount drawn. Costs rise with each stage—plan for the ramp-up.

- Valuation/inspection fees: Some lenders charge per inspection. Ask for a fee schedule upfront.

- Rent and living costs: If you’re renting during the build in Brisbane or the Gold Coast, add a conservative buffer for potential weather or supply delays.

- Variations and upgrades: Keep a 5–10% contingency. Even smart upgrades can impact cashflow.

- Site and services: Allow for power/water/NBN connections, landscaping, driveway, and fencing (including a pool’s glass fence or government-certified fence if applicable).

Pro tip: Early selections reduce variation risk. Lock in kitchen, bathrooms, flooring, façade materials, and confirm white colour bond roofing early.

Brisbane and Gold Coast specifics that matter

- Climate-first design: A white colour bond roof reflects heat, making homes more comfortable with lower cooling costs—especially valuable in Brisbane and Gold Coast summers. Combine with shading, insulation, and cross-ventilation.

- Overlays and compliance: Flood or bushfire overlays can affect foundations, materials, and site levels. Address early—it can support better valuations and smoother lending.

- Pools and safety: Plan fencing timelines so pool compliance is achieved before handover. Glass fences are a popular choice for style and visibility; ensure they meet QLD standards and are certified.

- Suburb comparables: Valuers reference recent sales. If you’re in a fast-developing corridor, relevant comparables help substantiate the on-completion value.

Timelines: a simple progress payment stages timeline

Every build is unique, but here’s a practical timeline many first home buyers can use as a working plan:

- Month 0–1: Finance pre-approval; shortlist builder; design and pricing refinement

- Month 1–2: Fixed-price contract; unconditional approval; land settlement (if applicable)

- Month 2–3: Site start; Base/Slab progress payment

- Month 3–4: Frame progress payment

- Month 4–5: Enclosed/Lock-up progress payment

- Month 5–6: Fixing progress payment

- Month 6–7: Practical completion (Final draw), compliance checks, handover

Modular prefabricated builds with The Markon Group can reduce on-site time because much of the build is completed in a controlled environment, then installed and finished on site—often smoothing the draw schedule and reducing weather risk.

Tip for your visual: Sketch a horizontal timeline with simple milestone icons (slab, frame, lock-up, fixing, keys). Under each, note “Builder invoice → Your sign-off → Lender inspection (if requested) → Bank draw.”

The 10 most common progress payment pitfalls—and how to avoid them

1, Vague or incomplete contracts

- Fix: Use a fixed-price contract with a clear progress schedule, inclusions, and specifications (including white colour bond roof).

2, Underestimating site costs

- Fix: Get soil tests, engineering, and overlay checks early. Keep a contingency.

3, Slow claim approvals

- Fix: Nominate one decision-maker; respond fast; pre-book valuations when possible.

4, Mid-build scope creep

- Fix: Finalise selections pre-start. Batch any required changes and understand impacts.

5, Valuation mismatches

- Fix: Work with your builder to align specs with valuation expectations; provide relevant local comparables.

6, Poor document management

- Fix: Keep a single digital folder for plans, contracts, insurances, variations, and certificates. Share promptly with your lender.

7, Pool fence compliance left to the last minute

- Fix: If a pool is included, plan for a glass fence or a government-certified fence early and schedule certification before handover.

8, Ignoring climate-smart design

- Fix: Choose a white colour bond roof, insulation, shading, and ventilation. It’s kinder on your budget and your comfort.

9, Weak contingency planning

- Fix: Hold 5–10% contingency for surprises; don’t max out every dollar on day one.

10, Communication gaps between lender, builder, and owner

- Fix: Keep everyone in the loop. Small updates prevent big delays.

Lender expectations: keep draws moving

- Be prompt: Approve invoices quickly. A single missed email can stall trades.

- Anticipate inspections: Some draws trigger a valuer visit. Account for 2–5 business days.

- Share changes early: Variations that alter contract value or structure need lender visibility.

- Store everything: Your lender will love that one folder with the latest documents.

FAQs for first home buyers in QLD

Q: Is a construction loan harder to get than a loan for an established home?

- Different, not necessarily harder. There’s more paperwork (plans, contracts, progress schedules), but a good builder and clear documentation make it straightforward.

Q: How do repayments work during construction?

- Typically interest-only on drawn funds. This helps early on, but increases as stages are paid. Budget for the ramp-up.

Q: Can I include landscaping, driveway, and fencing in the contract?

- Yes; including these helps valuations and final draw planning. If a pool is included, ensure a compliant glass fence or government-certified fence is installed and certified before handover.

Q: What happens if weather delays a stage?

- Your contract outlines allowable delays. Keep your lender informed so inspections and payments can be rescheduled without stress.

Q: Do modular prefabricated homes affect the draw schedule?

- They can. Factory milestones may shift some funding to earlier manufacturing stages, with reduced on-site time. The Markon Group documents these milestones so lenders can align inspections and draws.

Q: Do I need a bigger deposit for construction?

- Not necessarily. Requirements vary by lender and LVR. Land equity can help. Your broker can compare options.

Handy checklists you can save

Finance and paperwork

- Pre-approval in writing, with estimated project budget

- Fixed-price contract with a clear progress payment schedule

- Builder licence and QBCC Home Warranty Insurance

- On-completion valuation complete

- Folder with all documents: plans, inclusions, variations, certificates

Selections and design

- Finalise kitchen, bathrooms, flooring, façade, and lighting early

- Confirm white colour bond roof and complementary thermal strategy (insulation, shading)

- If a pool is included, plan for a glass fence or a government-certified fence and schedule certification ahead of handover

Stage-by-stage approval

- Review what each stage includes per your contract

- Check workmanship aligns with plans/specs before approving claims

- Respond quickly to lender/valuer requests to avoid idle days on site

Handover readiness

- Practical completion inspection and defect list

- Collect warranties, manuals, and certificates (including pool compliance if relevant)

- Confirm home insurance and contents cover from handover date

- Set up your loan to switch to principal-and-interest (unless otherwise arranged)

How The Markon Group and Homes by Markon make this easier

The Markon Group is a custom home builder known for thoughtful design, honest advice, and quality execution across Queensland. The team also designs and imports custom-built modular prefabricated buildings—ideal when you want precision, quality control, and faster on-site delivery.

Homes by Markon focuses on a client-friendly, build-ready pathway:

- Clear, compliant progress payment schedules aligned to lender expectations in QLD

- Detailed inclusions and transparent pricing (including climate-smart specifications like a white colour bond roof)

- Guidance on site costs, overlays, and valuation-aligned design choices

- Coordination with lenders and brokers to keep each draw moving

- Practical compliance planning, including pool fencing (glass fence or government-certified fence) and timely certification when pools are part of the plan

Whether you’re in Brisbane, on the Gold Coast, or building regionally, you’ll benefit from teams who understand local conditions, council processes, and the small details that keep approvals—and trades—moving.

From planning to keys: a realistic mindset

The most successful first home builds in Queensland share three traits:

- Clarity: A fixed-price contract, well-defined progress schedule, and tidy documentation.

- Communication: Builder, lender, and owner talking early and often.

- Climate smarts: Design choices like a white colour bond roof, good insulation, and ventilation that cut running costs and keep homes comfortable.

Follow the stages, stay across your approvals, and protect your contingency. Do that, and progress payments become a simple rhythm: build, verify, authorise, draw—repeat—until you’re holding the keys.

Speak with Homes by Markon about build-ready steps

If you’d like a friendly walkthrough of the whole process—from pre-approval to final draw—Homes by Markon can map your progress payment timeline, coordinate with your lender, and tailor your selections for Brisbane, Gold Coast, or anywhere in QLD.

Let’s turn your first home from a plan into a confident, well-financed build.